Hi,

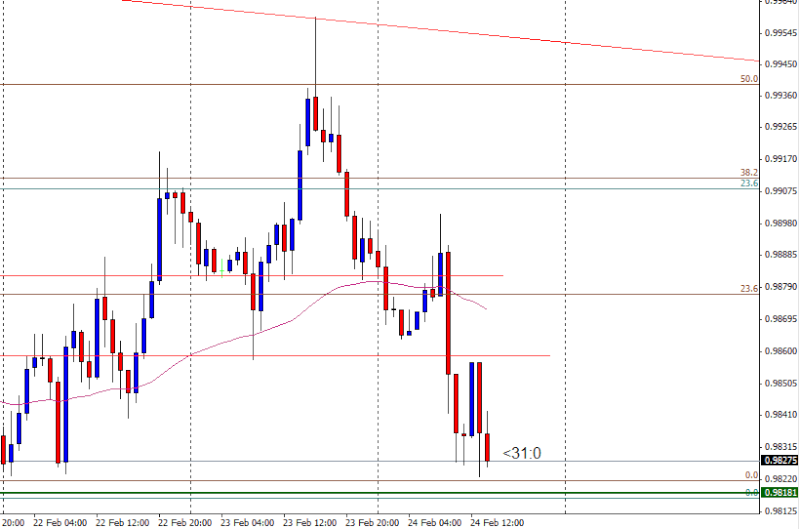

Didn't have time to post this one at the time, however I would like to use this as an example of trade management and risk/reward questions.

Entry was taken at break of hourly pin touching descending trend line. Entry was 0.9921, overall target was previous major support at 0.9826. Risk was 42 pips. Final target was 95 pips.

Without closing this trade early, this would have netted an R:R of 2.26, however my trade netted me an R:R of 1.23 as I partially closed the trade out at two minor S/R levels on route and finally at the target.

I get the feeling a 1.23 R:R will not see my reach consistently profitable trading, however equally looking at this chart price had to move a long way to get to 2.26 R:R which will not always happen...

So I guess I'm interested to know how others would have managed this trade? Whether we should close out trades partially on route to a final target? or just get a stop to BE at say 1:1 R:R or first S/R level and then shoot for 2:1 , 3:1 R:R or settle at BE?

Any thoughts most welcome!

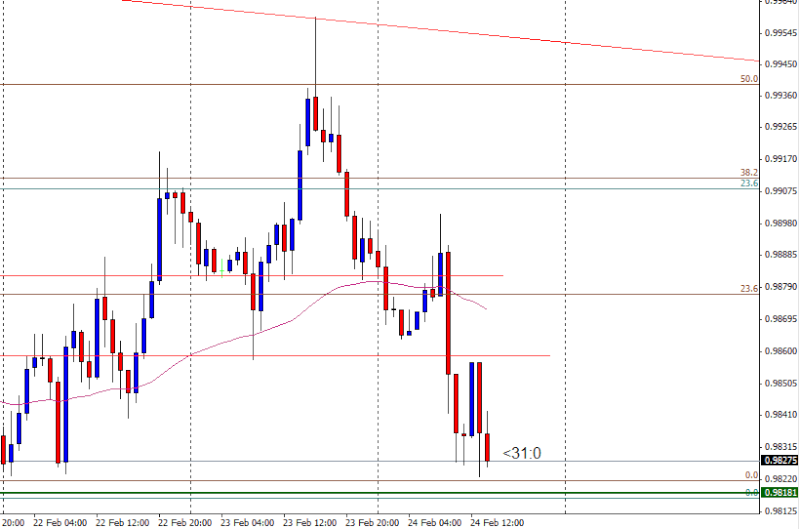

Didn't have time to post this one at the time, however I would like to use this as an example of trade management and risk/reward questions.

Entry was taken at break of hourly pin touching descending trend line. Entry was 0.9921, overall target was previous major support at 0.9826. Risk was 42 pips. Final target was 95 pips.

Without closing this trade early, this would have netted an R:R of 2.26, however my trade netted me an R:R of 1.23 as I partially closed the trade out at two minor S/R levels on route and finally at the target.

I get the feeling a 1.23 R:R will not see my reach consistently profitable trading, however equally looking at this chart price had to move a long way to get to 2.26 R:R which will not always happen...

So I guess I'm interested to know how others would have managed this trade? Whether we should close out trades partially on route to a final target? or just get a stop to BE at say 1:1 R:R or first S/R level and then shoot for 2:1 , 3:1 R:R or settle at BE?

Any thoughts most welcome!