Hi Guys,

First post in my section

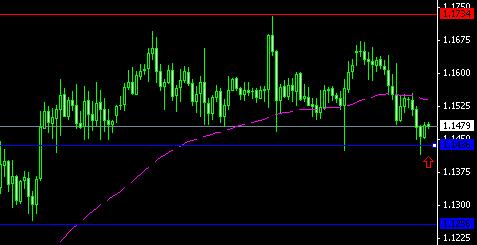

Have just entered USD/CHF off the 4 hour chart based on a recent SR level and 61.8% fib from the recent low being sliced by an average looking pin bar. Entry was taken 2 bars later than the pin bar, however I have justified it as I would have entered on the break of the pin bar and price is still at this level.

Not sure if this one will work out therefore have not risked a great deal on the trade, stop is below the tail of the pin. Will shoot for a target of 1.1675 or above.

First post in my section

Have just entered USD/CHF off the 4 hour chart based on a recent SR level and 61.8% fib from the recent low being sliced by an average looking pin bar. Entry was taken 2 bars later than the pin bar, however I have justified it as I would have entered on the break of the pin bar and price is still at this level.

Not sure if this one will work out therefore have not risked a great deal on the trade, stop is below the tail of the pin. Will shoot for a target of 1.1675 or above.